Heritage Foundation: Grading Congressional Tax Bills: “B” for the House, “D” for the Senate

A nice analysis by Daniel J. Mitchell of the two tax bills making their way through the House and Senate can be found at 'Grading Congressional Tax Bills: “B” for the House, “D” for the Senate':

By the way, a study by the Senate Finace Committee (pdf) found that 234,771 Ohioans would benefit from a provision called AMT Hold-Harmless (pdf) in the Senate Bill. This provision would limit the affect of the Alternative Minimum Tax and is the largest tax cut in the Senate Bill. The ten states that have more taxpayers affected by the AMT are California, Texas, Florida, Illinois, New York, Pennsylvania, Michigan, New Jersey, Virginia and Massachusets.

Senate Majority Leader Frist says that time has run out to deal with the AMT which is affecting more and more taxpayers. The House passed a separate bill addressing the AMT which is putting the reform in jeapordy.

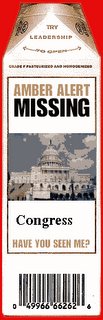

Our Congress at work...NOT!

...Conclusion

The House and Senate tax bills represent a tiny blip in the government’s finances. The basis for judging the two bills is not the size of the tax cut, but the bills’ components. The House legislation is far superior. The good provisions, particularly the extension of the 15 percent rate for dividends and capital gains, exceed the bad provisions. All told, the House bill gets a “B.”

The Senate does not fare as well. Its one genuinely desirable provision deals with small-business expensing. Its other provisions are bad, repugnant, or irrelevant. Even though the Senate bill is a net tax cut, it arguably would give America a worse tax code. At best, the Senate bill deserves a “D.”

By the way, a study by the Senate Finace Committee (pdf) found that 234,771 Ohioans would benefit from a provision called AMT Hold-Harmless (pdf) in the Senate Bill. This provision would limit the affect of the Alternative Minimum Tax and is the largest tax cut in the Senate Bill. The ten states that have more taxpayers affected by the AMT are California, Texas, Florida, Illinois, New York, Pennsylvania, Michigan, New Jersey, Virginia and Massachusets.

Senate Majority Leader Frist says that time has run out to deal with the AMT which is affecting more and more taxpayers. The House passed a separate bill addressing the AMT which is putting the reform in jeapordy.

Our Congress at work...NOT!

0 Comments:

Post a Comment

<< Home