Popular Mechanics: Disaster Repetitive Loss Analysis in the Gulf States

From Popular Mechanics Now What?, The The Lessons of Katrina (HT: BizzyBlog):

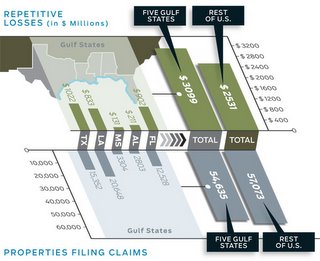

The chart above shows repetitive-loss property claims under the National Flood Insurance Program and the dollar amounts paid on those claims. (A repetitive-loss property is one with multiple insured losses due to floods within a 10-year period.) The five Gulf Coast states account for more than half the claims filed--a clear indication of the vulnerability of property in Hurricane Alley. The chart does not reflect claims made because of Katrina, Rita and Wilma. Insured losses for those storms are expected to top $22 billion.Their recommended solution:

NEXT TIME: Folks in Tornado Alley and along the San Andreas fault don't get federally backed insurance, so why should taxpayers subsidize coastal homes, many of them vacation properties? Before we start rebuilding "bigger and better," Congress should reform the flood insurance program. A good start: Structure premiums so the program is actuarially sound and clamps down on repetitive claims.

Another option is for the government to buy out homeowners in vulnerable communities, just as it did along the Mississippi River following the floods of 1993. "The only problem is that it is going to cost more to buy out properties along the shore than it is to do it in North Dakota," says Andrew Coburn of Duke University's Program for the Study of Developed Shorelines. "The concept is still solid. It's just going to take more dollars."

Labels: Hurricane Katrina

1 Comments:

Gee, here's an easy fix: Government gets out of offering insurance and turns it back over to the free market. Of course it's a little hard to kill this handout off when our congress and senate members are enjoying houses in these areas and the cheap insurance that comes with them.

Repeal the 17th and we might return integrity to our government because "we the people" might actually be in control of government again.

Post a Comment

<< Home