Someone should tell Ed Markey that Exxon is a major investment in his homestate's pension plan

Exxon Mobil reported quarterly profits of $10.36 billion, second only to the $10.71 billion profit mark set in the fourth quarter of 2005.

'I care for the consumer' - reaction from a politician in 5 - 4 - 3 - 2 - 1:

Mr. Markey's reaction should not be surprising considering that he has called for a Windfall Profits Tax on oil companies.

Someone on the Congressman's crack staff should point out to him that his homestate's pension fund actually has Exxon Mobil as the #1 stock holding in its Domestic Equity Portfolio. The tax he's promoting would impact the benchmark beating returns the fund managers gloat about.

From page 55 of the fund's 2005 report:

'I care for the consumer' - reaction from a politician in 5 - 4 - 3 - 2 - 1:

July 27, 2006 - MARKEY: AMERICANS TIPPED UPSIDE DOWN AT GAS PUMP AS EXXON REAPS RECORD PROFITS

Washington, D.C. -- Today, Rep. Ed Markey (D-MA), a senior member of the House Energy and Commerce Committee, released the following statement on the massive profits announced by Exxon Mobil in their second quarterly earnings report this year:

“On the eve of the first anniversary of the passage of the Bush Energy plan, Exxon Mobil said it earned over $10 billion this quarter, the second largest quarterly profit ever recorded by a publicly-traded U.S. company. While American families get tipped upside down and have their savings shaken out of their pockets at the gas pump, the Bush-Cheney team devises even more ways to line Big Oil’s pockets. The country is demanding a new direction, starting with tough fuel economy standards that will save them from more pain at the pump; unfortunately, the President is at the economic and diplomatic wheel of this country and is heading for a brick wall.”

Mr. Markey's reaction should not be surprising considering that he has called for a Windfall Profits Tax on oil companies.

Someone on the Congressman's crack staff should point out to him that his homestate's pension fund actually has Exxon Mobil as the #1 stock holding in its Domestic Equity Portfolio. The tax he's promoting would impact the benchmark beating returns the fund managers gloat about.

From page 55 of the fund's 2005 report:

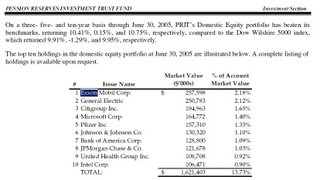

On a three- five- and ten-year basis through June 30, 2005, PRIT’s Domestic Equity portfolio has beaten its benchmarks, returning 10.41%, 0.15%, and 10.75%, respectively, compared to the Dow Wilshire 5000 index,which returned 9.91%, -1.29%, and 9.95%, respectively.Exxon represents 2.18% of the Domestic Equity Portfolis with a total investment of more than $257 million:

The top ten holdings in the domestic equity portfolio at June 30, 2005 are illustrated below.

0 Comments:

Post a Comment

<< Home